Introduction

Building credit is essential for businesses looking to establish financial credibility and access to funding. One effective way to boost your business credit score is through a Business Credit Builder program. In this article, we will delve into the benefits, workings, and frequently asked questions surrounding Business Credit Builders.

Benefits of Business Credit Builder

By enrolling in a business credit builder program, you can:

- Establish a separate credit profile for your business

- Improve your business credit score

- Increase your chances of securing loans and financing

- Access higher credit limits and better terms

- Protect your personal credit score

Detailed Explanation

A BUSINESS CREDIT BUILDER helps businesses establish or improve their credit profiles by offering services such as business credit builder accounts, cards, and loans. These programs work by providing businesses with access to tradelines and services tailored to boost their credit scores. By making timely payments and managing credit responsibly, businesses can build a solid credit history.

Frequently Asked Questions

1. What are BUSINESS CREDIT BUILDER Companies?

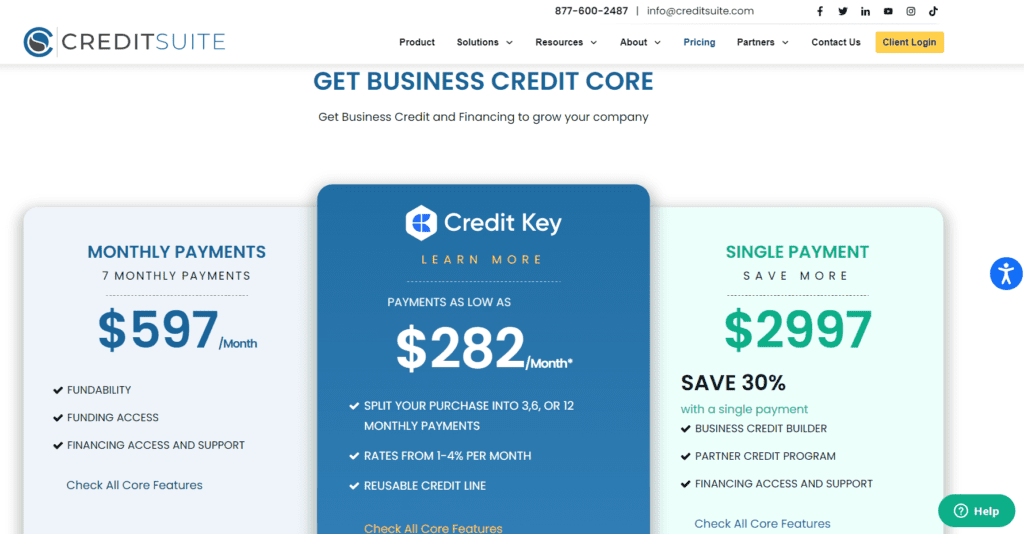

BUSINESS CREDIT BUILDER companies specialize in helping businesses build credit by offering services such as tradelines, credit cards, and loans tailored to improve credit scores.

2. How do Business Credit Builder Cards Work?

BUSINESS CREDIT BUILDER cards function like traditional credit cards but are designed to help businesses establish or improve their credit profiles by reporting positive payment history to credit bureaus.

3. What are business credit builder tradelines?

business credit builder tradelines are accounts or credit lines that are reported to business credit bureaus to help companies establish credit history and improve their credit scores.

4. What services do Business Credit Building Services Offer?

Business Credit Building services provide businesses with tools and resources to help them manage and improve their credit scores, including credit monitoring, reporting, and guidance on credit-building strategies.

5. Where can I find Business Credit Builders Reviews?

Reviews of Business Credit Builders can be found online on platforms like Trustpilot, Yelp, and Google Reviews, where businesses share their experiences and feedback on different credit building programs.

Conclusion

Building strong business credit is crucial for the financial health and growth of your company. A business credit builder program can help you establish and strengthen your business credit profile, opening up opportunities for better financing options and favorable terms. By understanding how Business Credit Builders work and utilizing their services wisely, you can pave the way for a successful financial future for your business.